The UK market took matters into its own hands last week, gaining £4.65/MT on LIFFE against a quieter back-drop elsewhere. Dry weather has led some to talk of a sub 10 million tonne wheat crop for the UK

Read MoreFutures markets have returned now to the upper end of their current range. Put simply, buyers have returned for new crop demand

Read MoreAs we are seeing the first cautious easing of the lockdown measures in England, there is also a sense of some

Read MoreUK wheat was quietly supported last week, finishing at a €3/MT discount to French after being at parity during April

Read MoreThe contract is for an agreed tonnage of winter oats, variety Mascani. The Oats must conform to all UK and EU regulations pertaining

Read MoreWe have a shortened week with a rare Friday Bank Holiday in the UK to mark the 75th Anniversary of VE Day

Read MoreLast week’s briefing asked whether market selling would spill over from the previous week and push down through long term support levels

Read MoreMarkets start firmer today after last week’s correction off the highs. New crop wheat has now returned to the level that was a strong

Read MoreRussia’s wheat crop this season is forecasted at 84.4 mln MT, which if achieved would be 10 mln MT larger than in 2019

Read MoreIn normal times we would be talking of markets winding down for Easter, but the holiday feels more like a footnote in current circumstances

Read MoreLast week markets failed to extend the rally and ended unchanged. Going into the second week of lock-down there is a new normal

Read MoreThe coronavirus pandemic continues to add huge volatility into our global grain markets – both on physical supply/panic buying and on economic factors including oil devaluation and currency exchange. French wheat markets rallied €21/MT last week, back to the contract highs set back in January.

Read More

With spring definitely in the air and a good planting window opening, now is the moment of truth for 2020 spring barley plantings.

Read MoreAn active market as the markets get to grips with the scale and potential fallout from Coronavirus.

Read MoreOur grain traders look at the week ahead. Coronavirus and equity markets continue to dominate the headlines.

Read MoreStock markets, Oil prices, and french spring crop drilling are all factors in this week’s market briefing.

Read MoreOur traders explain how cheap German ‘A’ Milling wheat imports are placing a cap on UK Group 1 milling values.

Coronavirus has shaken markets globally, pulling the FTSE 100 and S&P 500 down over 8% in a week. But what does this mean for UK grain markets?

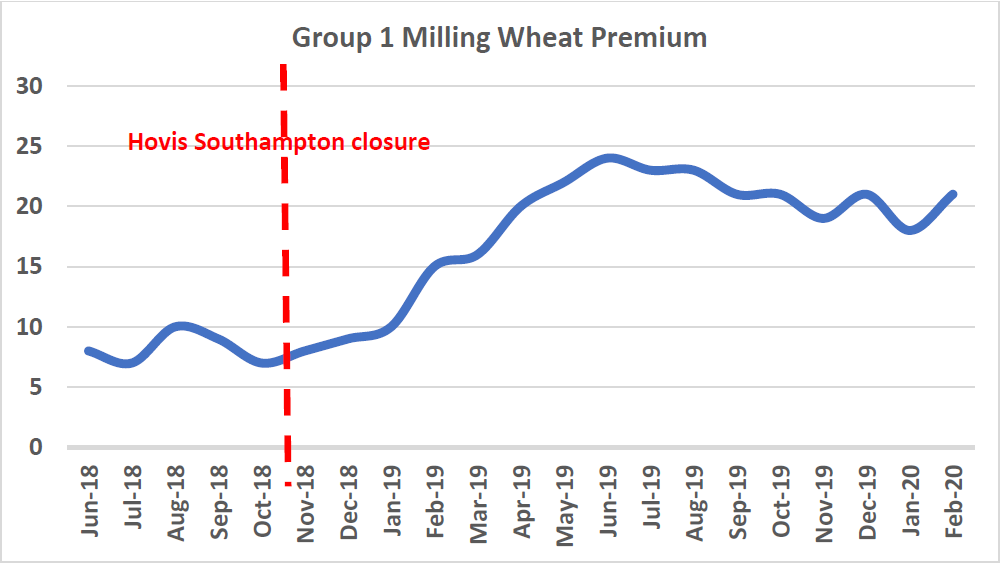

Read MoreWith the closure of Ranks Hovis Southampton, Martin Perry looks at the subsequent premium following this change in the marketplace.

Read MoreMartin Perry, Senior Trader at Bartholomews, looks into the wider European markets and how pricing impacts closer to home than most expect.

Read More